Portfolio Analytics

Consolidated view of all your investments across stocks, mutual funds, and F&O. Connect with Kite to fetch holdings and perform comprehensive statistical analysis across 9 different timeframes with institutional-grade precision.

Core Features

- Kite Integration for Live Holdings

- 9 Timeframe Analysis

- Stocks, MF & F&O Consolidated View

Advanced Analytics

- Multi-timeframe Portfolio Insights

- Weighted vs Equal-weighted Analysis

- Portfolio Health Assessment

Risk Management

Comprehensive risk assessment tools including VaR calculations, drawdown analysis, and stress testing. Protect your capital with advanced risk metrics and early warning systems.

Risk Metrics & Analysis

- Value at Risk (VaR)

- Expected Shortfall (CVaR)

- Maximum Drawdown

- Beta Analysis

Risk Parity & Controls

- Position Size Limits

-

Sector Allocation Limitscs

-

Daily Loss Limitscs

-

Real-time Risk Alertscs

Quant Insights

Advanced quantitative analysis and insights powered by institutional-grade algorithms and data science.

Performance Analytics

Statistical Analysis

Data Visualization

Interactive, professional-grade charts and visualizations to understand your portfolio performance and market dynamics.

Portfolio Visualizations

Advanced Charts

Quasi-Real-Time Monitoring

Comprehensive monitoring system for portfolio performance, system health, and market conditions with live updates.

Portfolio Monitoring

System Health

Advanced Analytics

Sophisticated statistical models and quantitative analysis tools for deep portfolio-level insights and performance attribution.

Statistical Analysis

Performance Attribution

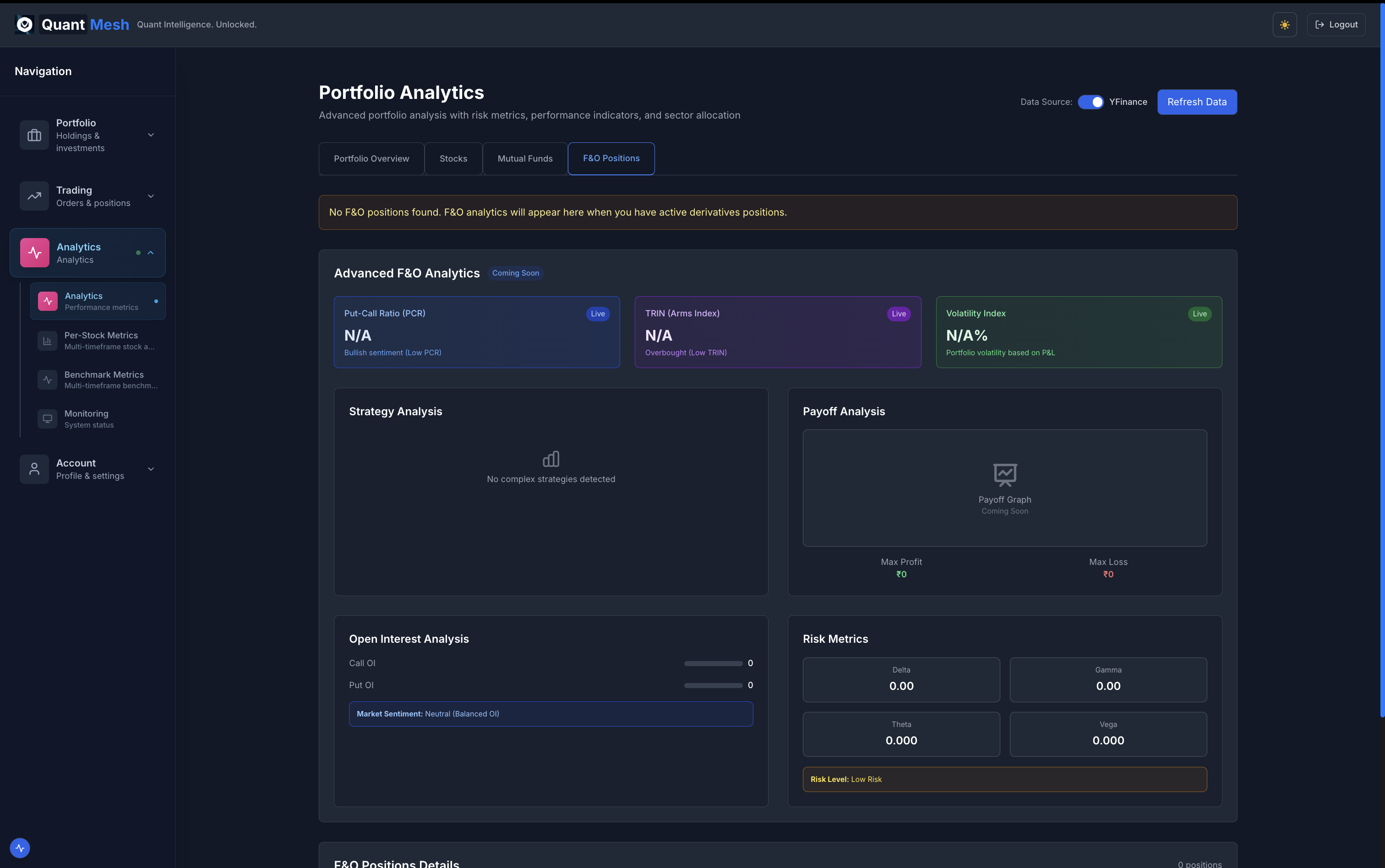

F&O Analytics

Comprehensive derivatives analysis with strategy identification and risk management for futures and options trading.

Position Analysis

Strategy Detection

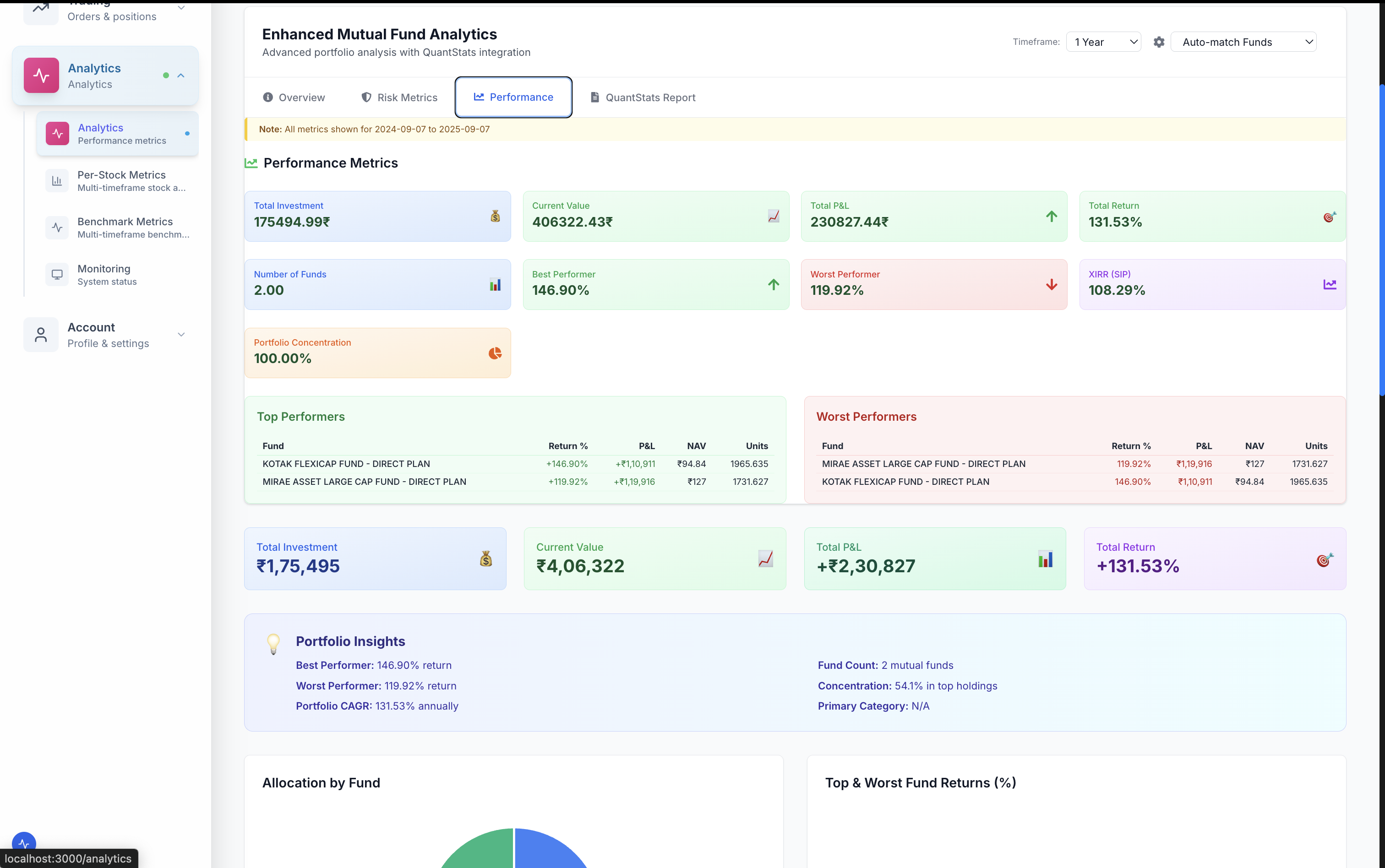

Mutual Fund Analytics

Comprehensive mutual fund analysis with real NAV data integration and advanced metrics powered by QuantStats.

Enhanced MF Analytics

Performance Analysis

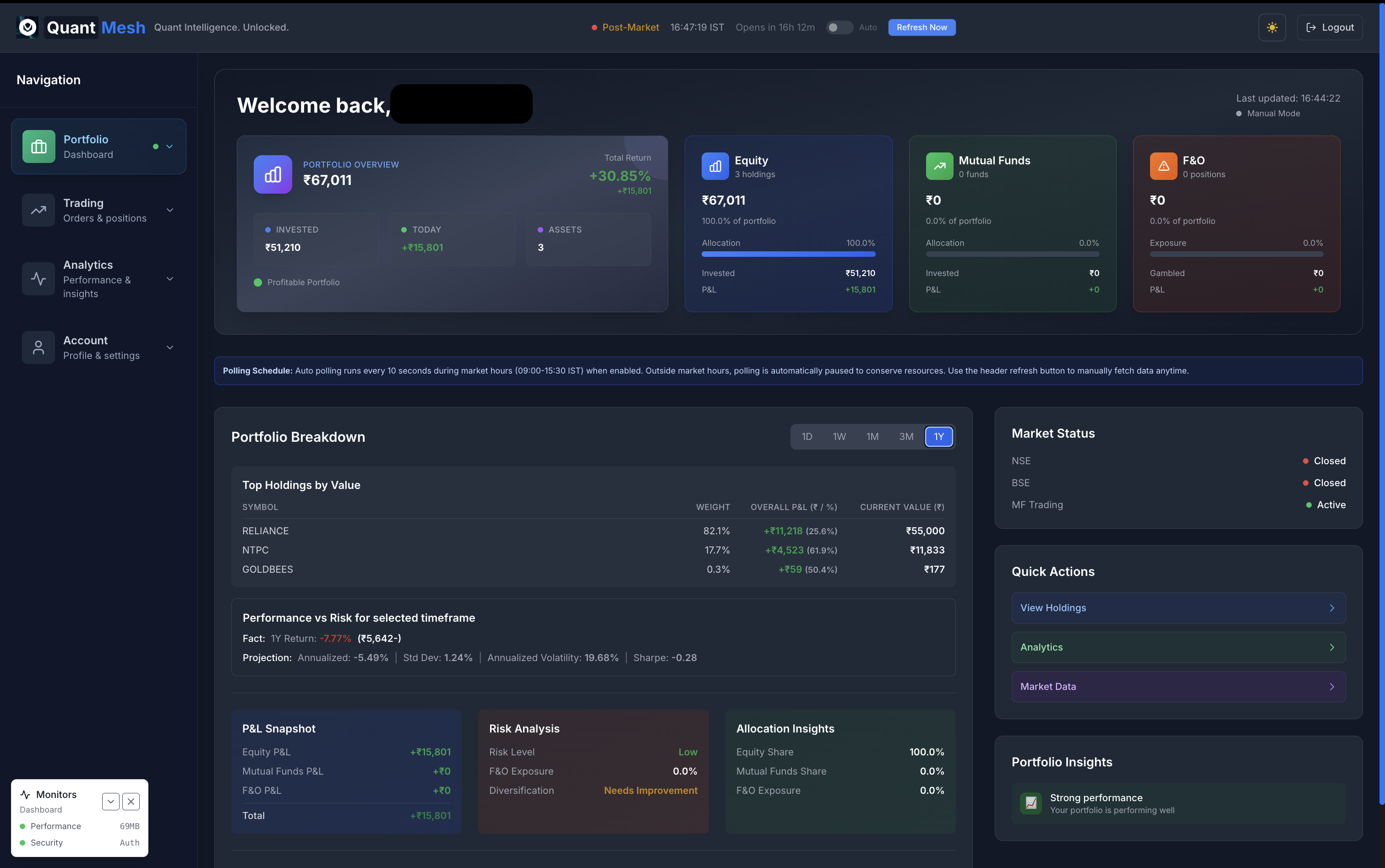

Platform in Action

See how QuantMesh transforms raw data into actionable trading insights

Portfolio Performance Analysis

Risk Management Dashboard

Portfolio Insights

Deep analytical insights across your entire portfolio with advanced statistical modeling and comprehensive performance attribution analysis.

Core Analytics

- Multi-asset analysis

- Performance attribution

- Risk-return optimization

Advanced Features

- Sector allocation analysis cs

- Correlation matrices

- Portfolio optimization